Steuer Auf Hohe vermögen The Vermögensteuer, sometimes known as the Vermögenssteuer, is a tax levied against a person’s total assets when they become a taxpaying entity. In most cases, the residual wealth left over after debts have been discharged serves as the basis for their calculations. She is included in the category of vermögensbezogene taxes, as are taxes that do not apply to the whole amount of assets, but rather to specific assets, such as the general sales tax (general sales tax).

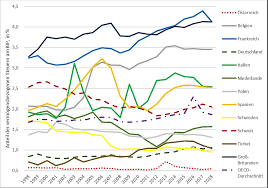

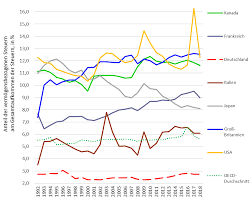

From 1998 to 2018, the average of the OECD countries saw a decrease in the revenue from vermögensbezogene taxes at the base inflation rate of between 1,7 and 2,3 percent. In this period, the Swiss government reduced its share of vermögensbezogene taxes and drew closer to the OECD-Durchschnitt, whereas Germany and Austria were among the European OECD-Lands with the lowest share of vermögensbezogene taxes. In Germany, the actual wealth tax, as defined by the applicable Vermögensteuergesetz.

is a stichtagsbezogene Substanzsteuer that is calculated on the basis of the value of the net assets (gross assets Businesses, real estate, savings accounts, stocks, bonds, and life insurance, as well as luxury and art objects, are all included in the calculation of the measurement basis. Individuals who are subject to taxation include both natural and legal entities. Natural persons are entitled to a free-of-charge sum of 120.000 DM, which is about 61.355 Euro, pursuant to Section 6 of the VStG.

The last time the wealth tax was collected was in 1996, when the total amount of money collected was around 9 billion DM.

The Wealth Tax served as a countries tax for the federal states (Art. 106 Abs. 2 Nr. 1 GG). The Bundesverfassungsgericht ruled in 1995 that a different taxable burden on land and other assets under the auspices of the Vermögenssteuer was incompatible with the Equalitygrundsatz (Article 3 Abs. 1 of the German Constitution). Despite the fact that the then-current federal government determined that there was no constitutionally mandated obligation to abolish the wealth tax during the consultations on the new tax law in 1997, the wealth tax will no longer be collected with effect from 1997, despite the fact that the wealth tax statute is still in effect.

During the 1920s, the vermögensbezogene Besteuerung accounted for around 2.5 percent of the BIP. She was significant until the 1970s, when she lost her significance. According to a recent article in the SZ, the current vermögensbezogene Besteuerung in Germany is considered to be rather low. This was also due to the fact that, in other countries, a higher rate of basic income tax would be levied.

A result of the low level of taxable taxable income, Germany was designated as a “Reichenparadies” by the World Bank in 2013. n In Austria, there was a wealth tax on net worth that existed until 1993. It generated 511 million euros in revenues in 1990, accounting for one percent of the total tax revenue collected that year. The majority of the tax-collecting businesses were represented in this group.

In 1993, on the initiative of the Social Democratic Finance Minister Ferdinand Lacina, the Wealth Tax was abolished since it targeted mostly corporations and not well-to-do individuals – who were thus protected from disclosure by the banking secrecy. Instead, Lacina proposes a reform of the general taxation system and the estate taxation system, but no such reform has been implemented. [18] In Austria, the inheritance tax was raised by a further 1% until the year 2008.

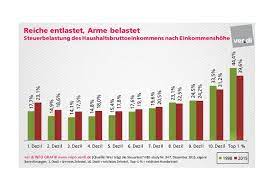

According to a representative poll conducted in early 2020, 64 percent of the population supported the imposition of capital gains taxes on assets worth more than one million euros, and 66 percent supported the imposition of capital gains taxes on inheritances worth more than one million euros.

Bei der Vermögenssteuer handelt es sich um eine Steuer, die jährlich auf das Gesamtvermögen des Steuerpflichtigen erhoben wird. The taxation of the reinvermögen, that is, the wealth remaining after the dissolution of contractual obligations (Schulden) and social benefits like as those provided by some Kantone for AHV- and IV-Rentners, will take place. In a few of jurisdictions, there is also a taxable wealth threshold. In this case, the Sollertrag will be taxed rather than the actual profit. Household goods, such as furniture and appliances, as well as savings and retirement funds, are exempt from taxation.

According to a study conducted by Ernst and Young and the arbeitgebernahe ifo Institute on behalf of the Federal Ministry of Economics and Energy in 2017 under Brigitte Zypries (SPD), the reintroduction of a company has negative consequences for economic growth and employment (S. 52), because foreign investors, in particular, would significantly reduce their involvement in the company.

With a 1 percent asset tax rate and a 1 million euro free-float, the state would collect an additional nearly 20 million euros per year from the asset tax. However, the state’s overall revenue from other taxes (such as income tax, sales tax, corporation tax, and capital-gains tax) would decrease by more than 50 million euros, resulting in the state running a “negative business.”